How to Apply for the Capital One Venture X Credit Card Easily

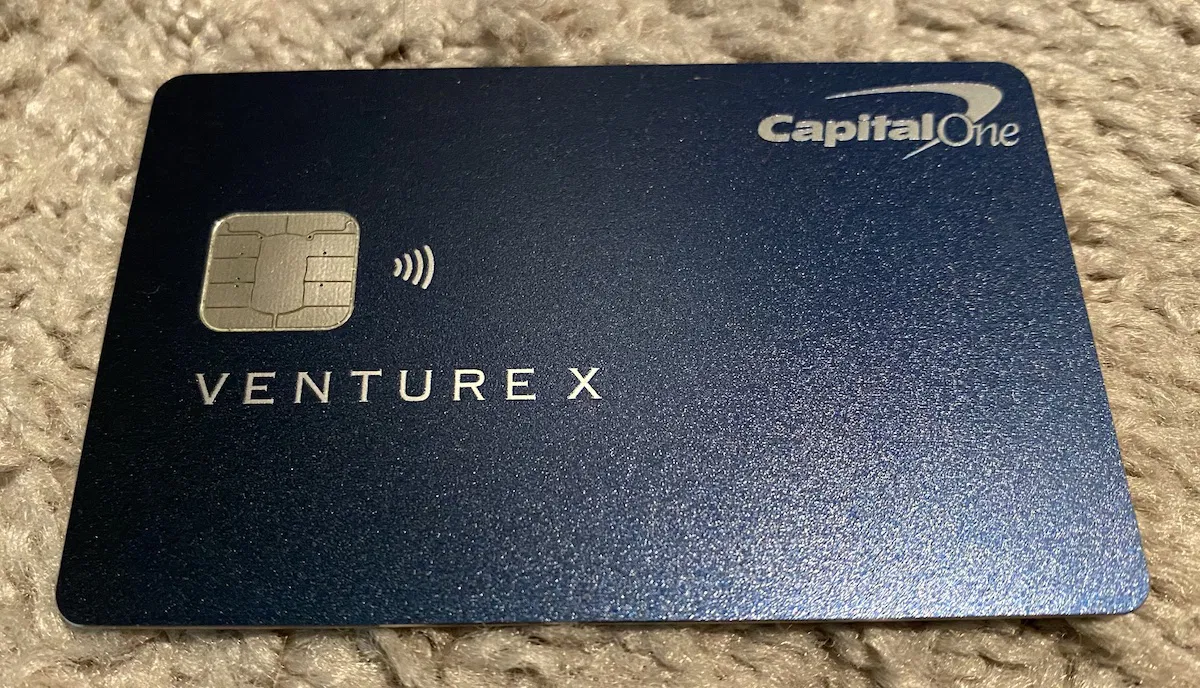

Unlock a world of seamless travel experiences and rewarding benefits with the coveted Capital One Venture X Credit Card. Whether you’re a frequent flyer or a casual traveler, this card is designed to enhance your journey by offering a robust rewards program and exceptional travel perks. Picture yourself earning unlimited miles on every purchase and enjoying exclusive access to lounges, all made possible by this feature-rich card.

Applying for the Capital One Venture X Credit Card is refreshingly straightforward, making it an attractive option for those looking to simplify their financial journey. With automated and user-friendly application processes tailored for U.S. residents, you’ll find yourself closer to the card’s generous sign-up bonuses and travel incentives. Ready to explore the world of possibilities? Dive into the ease of application and discover the benefits that await you with the Capital One Venture X Credit Card.

Benefits of the Capital One Venture X Credit Card

Generous Rewards on Every Purchase

The Capital One Venture X Credit Card offers an impressive rewards program where you earn unlimited 2X miles on every purchase, every day. This means that for every dollar you spend, you accumulate two miles, regardless of the category. It’s an excellent choice if you’re looking to maximize your earnings without needing to juggle different spending categories. To make the most of this benefit, consider using your card for regular expenses like groceries and dining out, supplementing your daily routine with future travel adventures.

Exceptional Travel Perks

One of the standout features of the Venture X card is its numerous travel benefits designed to enhance your experience. Enjoy up to $300 in annual credits for bookings through Capital One Travel, which significantly offsets the card’s annual fee. Plus, you get access to over 1,300 Priority Pass lounges worldwide. To optimize these perks, plan your trips and use the Capital One Travel portal to take full advantage of these credits and enjoy some relaxation in exclusive airport lounges.

Impressive Sign-Up Bonus

When you sign up for the Capital One Venture X card, you have the opportunity to earn an enticing sign-up bonus. Typically, after spending a certain amount on purchases within the first three months, you receive a significant amount of bonus miles. This substantial initial bonus allows new cardholders to kickstart their rewards journey impressively. To ensure you qualify, plan your spending strategically when considering major purchases or necessary household expenses.

No Foreign Transaction Fees

For those who travel internationally, the Capital One Venture X card is a trustworthy companion. It charges no foreign transaction fees for purchases made outside the United States. This feature can result in significant savings, as many other credit cards impose a surcharge on each transaction conducted in a foreign currency. To maximize this benefit, lean on your Venture X card for purchases during trips abroad to avoid additional fees and keep your budget on track.

LEARN MORE DETAILS ABOUT CAPITAL ONE VENTURE X

| Advantage | Description |

|---|---|

| Generous Rewards | Earn 2X miles on all purchases, enhancing travel opportunities. |

| Travel Benefits | Includes no foreign transaction fees and priority boarding. |

The Capital One Venture X card offers exceptional travel benefits, making it a strong choice for frequent travelers. One of its primary advantages is the ability to earn generous rewards on everyday spending. As a cardholder, you earn an impressive 2X miles on all purchases, which can significantly accumulate over time. This feature ensures that whether you are dining out, shopping, or refueling your car, you are consistently making progress toward your next travel adventure.In addition to the rewards structure, the card provides valuable travel-related perks that enhance the overall experience for users. One such benefit is the absence of foreign transaction fees. This is particularly beneficial for those who travel internationally, as it allows cardholders to use their card abroad without incurring hidden costs. Moreover, the card includes amenities like priority boarding, making your journey smoother and more enjoyable. These advantages not only make the Capital One Venture X card appealing but also position it as a powerful asset for managing travel expenses efficiently. By understanding and leveraging these benefits, users can maximize their travel experiences and rewards.

Key Requirements for Applying for the Capital One Venture X Credit Card

- Minimum Credit Score: To increase your chances of approval for the Capital One Venture X, you generally need a good to excellent credit score, typically above 700. This demonstrates your ability to manage credit responsibly.

- Proof of Income: Applicants should provide proof of a stable income. This can include recent pay stubs, tax returns, or bank statements. A higher income can improve your application strength.

- Identification Documents: Ensure you have valid identification ready, such as a driver’s license or passport, to verify your identity during the application process.

- Minimum Age Requirement: You must be at least 18 years old to apply for a credit card in the United States. Be prepared to confirm your age with appropriate documentation.

- Residency Status: Applicants need to be U.S. residents with a valid address. Having a consistent and verified address can aid in the application process.

VISIT THE WEBSITE TO LEARN MORE

How to Apply for the Capital One Venture X Credit Card

Step 1: Visit the Capital One Website

To start your application for the Capital One Venture X credit card, you’ll first need to visit the Capital One website. Open your preferred web browser and type www.capitalone.com in the address bar. Navigating to the website is important as this is where you’ll find all the necessary information and resources you need to begin the application process.

Step 2: Find the Venture X Credit Card Information

Once on the Capital One website, click on the ‘Credit Cards’ section, which is typically located at the top navigation bar. From there, look for the Venture X card under their list of available cards. Clicking on this will provide you with detailed information about the benefits, interest rates, and any current offers associated with the Venture X card. Take a moment to review these details to ensure the card aligns with your needs.

Step 3: Begin Your Application

After reviewing the card details, you’ll see an option to apply for the card. Click on this application button to begin the process. You’ll be prompted to fill out a form with your personal information, such as your name, address, income, and social security number. Make sure to fill in all the required fields accurately, as this information will be used to assess your eligibility for the card.

Step 4: Review and Submit Your Application

Before you submit your application, take a few minutes to review all entered details for accuracy. This is crucial because any mistakes might require you to restart the process. Once you are confident all the information is correct, click the ‘Submit’ button to send your application to Capital One for review.

Step 5: Wait for Application Approval

After submission, your application will be reviewed by Capital One. You will typically receive a decision via email within a few days. If approved, your new Capital One Venture X credit card will be mailed to you along with further instructions on how to activate and use it.

LEARN MORE DETAILS ABOUT CAPITAL ONE VENTURE X

Frequently Asked Questions About Capital One Venture X

What are the main benefits of the Capital One Venture X credit card?

The Capital One Venture X credit card offers numerous benefits that make it appealing for frequent travelers. Cardholders earn 2 miles per dollar on every purchase, making it easy to accumulate rewards. Additionally, users receive 10,000 bonus miles each anniversary year, which is equivalent to $100 towards travel. The card also includes complimentary airport lounge access, no foreign transaction fees, and reimbursement for Global Entry or TSA PreCheck.

Does the Capital One Venture X credit card have an annual fee?

Yes, the card does have an annual fee. As of now, the annual fee is $395. However, given the extensive travel benefits and rewards program associated with the card, many cardholders find the fee to be a worthy investment in exchange for the perks provided.

What credit score is needed for approval of the Capital One Venture X?

Applicants generally need to have excellent credit to be approved for the Capital One Venture X. This typically means having a credit score of 740 or higher. However, approval is not guaranteed, and factors like income, existing debt, and overall credit history also play a significant role in the decision-making process.

Are there any travel protections or insurance included with the Capital One Venture X?

Yes, the Capital One Venture X offers a variety of travel protections and insurance benefits, such as trip cancellation and interruption insurance, lost luggage reimbursement, and travel accident insurance. These features provide cardholders with added peace of mind while traveling, knowing they are protected against unforeseen events.

Related posts:

How to Apply for the Ally Platinum Mastercard Credit Card Effortlessly

How to Apply for the Luxury MasterCard Gold Credit Card Step-by-Step Guide

How to Apply for Bank of America Premium Rewards Credit Card

How to Easily Apply for a Citibank Credit Card Step-by-Step Guide

How to Apply for HSBC World Elite Mastercard Credit Card Online

How to Apply for the USAA Advantage Credit Card A Step-by-Step Guide

Beatriz Johnson is a seasoned financial analyst and writer with a passion for simplifying the complexities of economics and finance. With over a decade of experience in the industry, she specializes in topics like personal finance, investment strategies, and global economic trends. Through her work on our website, Beatriz empowers readers to make informed financial decisions and stay ahead in the ever-changing economic landscape.